Stay Safe in Floods

Flooding is a coast-to-coast threat to some part of the United States and its territories nearly every day of the year. This site is designed to teach you how to stay safe in a flood event. If you know what to do before, during, and after a flood you can increase your chances of survival and better protect your property. For instance, it is vital to know what to do if you are driving and hit a flooded road. Here you will find an interactive flood map, information describing the different types of flooding and educational material. You will also learn how the National Weather Service keeps you aware of potentially dangerous flooding situations through alerts and warnings.

Significant Florida Floods

- Cape Sable Hurricane of 1947

- Hurricane Dora 1964

- Okeechobee Hurricane of 1928

- Tropical Storm Debby 2012

- Tropical Storm Fay 2008

Flood Hazard Information

- Flash Flooding

- River Flooding

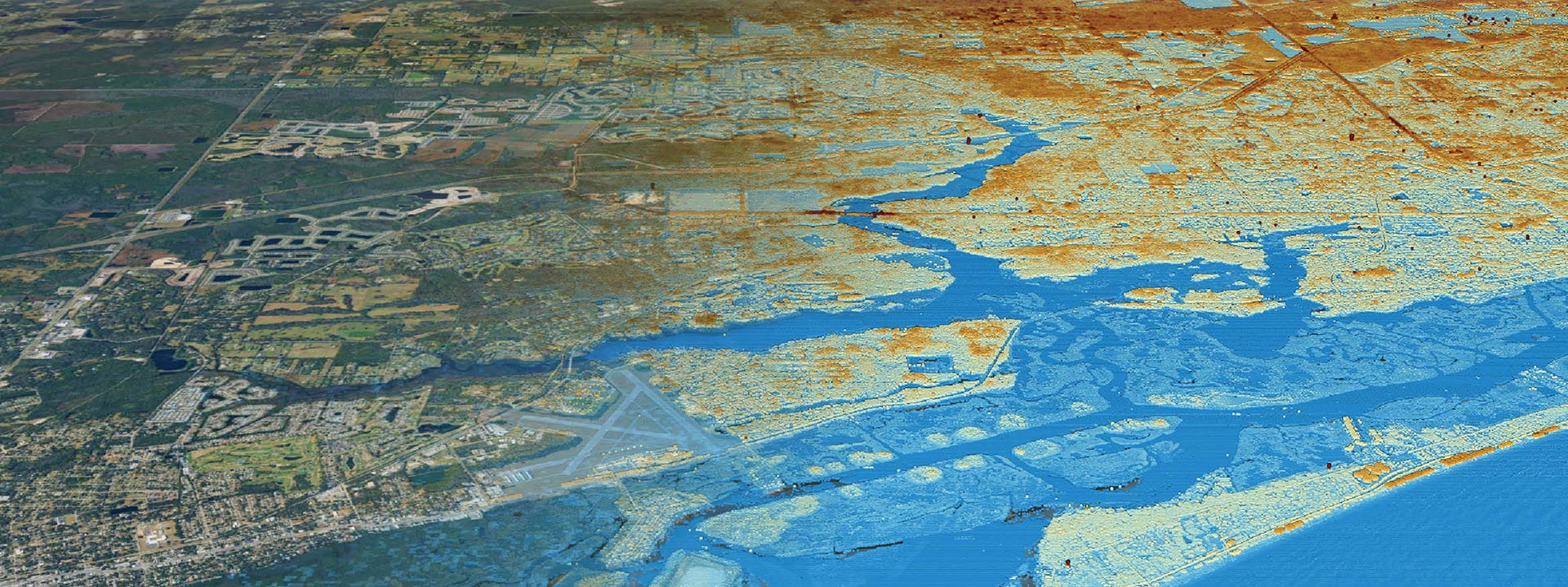

- Tropical Systems and Coastal Flooding

- Dam Breaks/Levee Failure

Flood Insurance

The National Flood Insurance Program provides insurance to help reduce the socio-economic impact of floods.

The National Flood Insurance Program (NFIP) is managed by the FEMA and is delivered to the public by a network of more than 50 insurance companies and the NFIP Direct.

Floods can happen anywhere — just one inch of floodwater can cause up to $25,000 in damage. Most homeowners insurance does not cover flood damage. Flood insurance is a separate policy that can cover buildings, the contents in a building, or both, so it is important to protect your most important financial assets — your home, your business, your possessions.

The NFIP provides flood insurance to property owners, renters and businesses, and having this coverage helps them recover faster when floodwaters recede. The NFIP works with communities required to adopt and enforce floodplain management regulations that help mitigate flooding effects.

Flood insurance is available to anyone living in one of the 23,000 participating NFIP communities. Homes and businesses in high-risk flood areas with mortgages from government-backed lenders are required to have flood insurance.

How to Purchase Flood Insurance

To purchase flood insurance, call your insurance company or insurance agent, the same person who sells your home or auto insurance. If you need help finding a provider go to FloodSmart.gov/flood-insurance-provider or call the NFIP at 877-336-2627.

Plan ahead as there is typically a 30-day waiting period for an NFIP policy to go into effect, unless the coverage is mandated it is purchased as required by a federally backed lender or is related to a community flood map change.

Work With the NFIP (Becoming a Seller and Servicer)

FEMA administers the NFIP and it is a partnership between the federal government, the property and casualty insurance industry, states, local officials, lending institution, and property owners.

Each year, more than 50 private insurance companies participate in the Write-Your-Own (WYO) program selling and servicing NFIP policies through their insurance agents.

FEMA retains responsibility for underwriting flood insurance coverage sold under that program and by the NFIP Direct. There are more than five million policyholders nationwide and the NFIP is the nation’s largest single-line insurance program providing nearly $1.3 trillion in coverage against flood.

Content sourced from: Flooding in Florida (weather.gov)